There is no getting away from it, the economy is going to be far more important in the next Scottish independence referendum than it was in 2014. This is partly because the Tories’ hard Brexit doesn’t just undermine, but completely destroys the economic case for the Union – a fact that will hit home as inflation rises and the Brexit negotiations start to go south for the Empire 2.0 team. Partly also because the only real weapon left to the Unionist campaign is to talk Scotland’s economy down by referring to the indicative financial deficit in the GERS reports. We can invest in renewables, no you can’t Scotland has a deficit, we can build a fairer nation, what with a £15bn deficit… you get the gist.

The Unionist mantra is that the fall in oil price has caused Scotland to have a greater deficit than the UK, and this makes sense until you start to realise that oil revenues didn’t fall by the same amount everywhere else in the world. It’s true the oil price slumped by around 55 per cent but Business for Scotland noticed UK Government revenues fell by 99 per cent, even though oil production rose by around 16 per cent during the same period. It doesn’t take a genius to figure out that something other than the price of oil, is impacting Scotland’s national accounts.

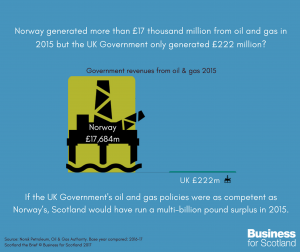

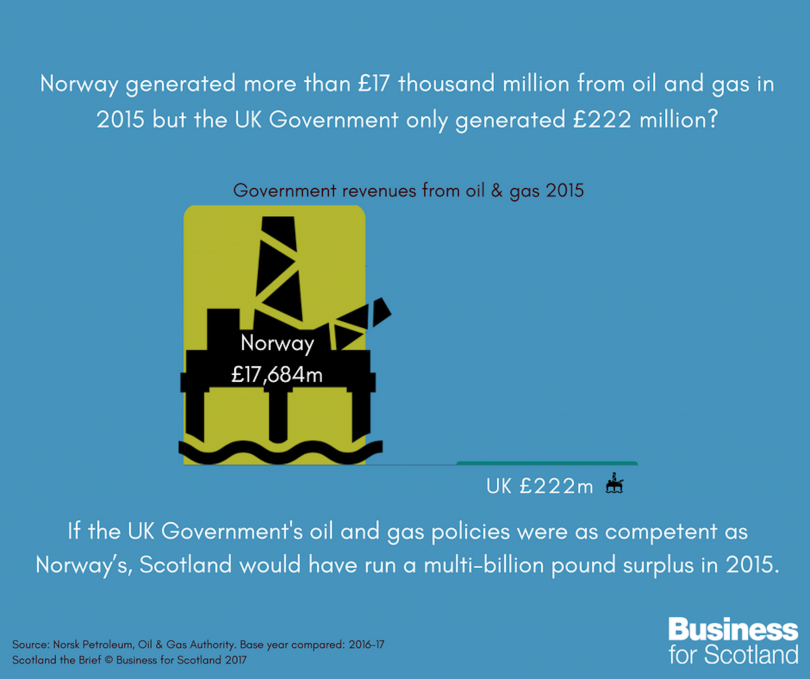

Our research published this week poses the question: If being part of the UK is such an advantage how come Norway, a comparable oil-producing nation, only saw a fall in revenues of only about 40 per cent when ours fell by 99 per cent? And more to the point how come small, and independent Norway’s revenues are 411 times larger than the UK’s? Norway generated £17.684 billion from oil and gas in 2015 but the UK Government only generated £222 million in its last published tax year.

The oil sector and their representative bodies make overreaching claims about the difference in one part of the north sea versus another and will claim that tax cuts were necessary at this point. However, a £17bn revenue gap cannot be justified without admitting to Westminster’s historical and significant generational economic mismanagement of Scotland’s oil sector.

Last year at The Times CEO summit George Osborne explained why the UK is not as rich as Norway when he said: “Four million people live in Norway, 65 million people live in this country, and they have the same amount of oil as us”. David Cameron made the same joke on the Andrew Marr Show and the fact that both of them used a 4m figure for Norway when it actually has a population of 5.258m (similar to Scotland), would suggest that is a joke they have shared between themselves and probably shouldn’t have made public.

So the bigger fall in Scotland’s revenues came not from the oil price but the tax breaks that the UK Government offered the industry. Of course, industry groups and the oil companies they represent will welcome such tax breaks and claim they are necessary, but when I looked deeper into the numbers it seems the UK has led the way in carving taxation costs out of its oil industry.

Looking at how the tax breaks apply to Shell and BP: in the 24 countries where Shell extracts oil and gas, all except the UK made Shell pay taxes. While the UK gave Shell £80m in tax rebates, Shell paid Norway £2.7bn. So, Norway generated 62 times more tax from one company than Westminster generated from the entire UK industry last year reported. Given that Shell alone cut up to 13,000 jobs and paid no corporation tax in the UK in 2015, it might surprise people that Shell paid £7.9 billion in shareholder dividends for that year, and in 2016 Shell paid out bumper £11.1 billion in dividends to its shareholders, more than any other company in the world.

Note: The UK’s figure for 2015 has been updated following the latest release of the UK Government’s revenues from the oil and gas industry.

BP also paints a familiar story: UK taxpayers paid BP £202 million in tax rebates in 2015 and of the 23 nations where BP extracted oil and gas, the UK was the only one where BP received money rather than paid taxes. Other countries received £10,148 million in taxes.

Mass job losses across the UK oil and gas sector coincided with these tax cuts and the SNP should ask the Westminster Government to make clear if it made any attempt to link these corporate tax breaks to protecting ordinary working people’s jobs in the sector. It does appear that Westminster policy is to protect corporations and their shareholder dividends, while not protecting people’s jobs, Scotland’s economy or it’s Government revenues. Aberdeen is clearly the region most directly affected by the oil price drop and when the region asked for help they made the case for £2.9 billion in economic support. In 2016, David Cameron visited the city and announced that Westminster would only offer £125 million. It was David Cameron who said that Scotland needed to rely upon the broad shoulders and deep pockets of the UK to maximise revenues from oil and gas — but I guess the broader the shoulders, the bigger the shrug?

So the next time you hear a Unionist saying that the GERS accounts show a deficit and that means Scotland can’t afford to be an independent country remember that Westminster runs Scotland’s economy. It is Westminster incompetence right from the outset in terms of resource governance that generated £17.8bn less oil and gas revenue in the last accounting year than Norway. So if Scotland had Norway’s oil revenues it would have run a multibillion-pound surplus in the last financial year.

It occurred to me that the Government wouldn’t just take a “hit” on tax just to put one over on the Scots. But they would if they could defer the tax take till it was in “London”.

So here i suggest is the Neocon way of achieving the same result and proving that “london” is the powerhouse of the UK.

Rather than Tax at the point of production you defer the Tax till it reaches the Bottom line and you tax the Profits rather than the Oil itself.

So they tax the Profits at 20% in the full knowledge they have been boosted by tax breaks and relief on oil production. But here comes the killer they Know that the oil companies will set record dividends and that comes in at a whopping 38% for high earners.

The best part about this is that the Money is now in the “appropriate” place and you can prove that the 2rich 2 really do “support” the poor as they pay more tax.

I have to admit this sounds cynicism and conspiracy even to my own ears.

The trouble i have is that if it looks like a frog, smells like a frog and blends like a frog (sorry Kermit) it usually is a frog.

Wonder what anybody else thinks?

Not for a heartbeat do I see the loss of taxes from the oilfields as being the result of poor decisions made in London,

they know EXACTLY what they’re doing, they are quite happy to GIVE the oil away for a period to show the Scottish economy in a poor light in the sure knowledge that when they’ve dealt with those pesky Nats once and for all they will be coining it in for generations from the trillions of pounds of taxes from the newly discovered fields around Scotland left to exploit!

I reckon the Uk will be getting their revenue via a different tax route agreed with the major oil companies so as to keep hidden the true numbers from Scotland. That is why it is essential for the UK that Scotland remains in the UK so as not to disclose the huge level of deceit perpetrated against the Scottish population.

The figures above are showing either a typing error or a huge mistake . Either way you need to fix it. I was trying to prove to my no voting partner that we could be a prosperous country. Thankfully I spotted this before I used your post. In your graph you quote in millions and in text it is billions? Which is it ?

Seventeen thousand million is 17 billion. The UK revenues were only £43m and Norways 411 times higher at £17,684m. Its not a mistake its just a really huge difference.

Oops sorry ,it is a HUGE difference. Will read it again. Thanks.

Thank you for confirming what I have always thought, that job losses in the oil and gas sector were political rather than economic. Another question to answer: why are revenues and profits from the gas as a separate item never listed?

Great exposure of past & current incompetence of all UK governments on a scale that is, even by their standards, well into the Twilight zone of economic madness. A couple of other factors are likewise on a massive scale and yet strangely never mentioned by the ‘better together’ people who prefer to focus on the recent price of oil and the supposed end of North Sea oil next Tuesday around 3pm.

Firstly as drilling technology improves the amount of oil that can be recovered from existing oil fields increases hugely, as does the ability to recover oil from areas previously outside existing drilling capabilities. Secondly there is growing evidence of other huge oil & gas reserves around Scotland. Yet none of this is mentioned by the droning ‘oil price low/NSO is gone’ Unionists. Shades of McCrone 2 ?

The numbers for lost and squandered revenues from the North Sea are astounding. As for the future, the numbers for oil revenues appear similarly massive, but how effectively these are managed will depend on who runs Scotland. Westminster’s track record speaks for itself. So what’s it to be? More UK incompetence (or treachery) or take control of it as an independent country along the lines that Norway has been doing for the past 40 years?

http://www.n-56.org/updates/scotland-set-oil-bonanza-heralds-new-golden-age-north-sea-lasting-another-century

https://www.oilandgaspeople.com/news/1039/scottish-west-coast-untapped-oil-and-gas-reserves-worth-trillions/

In order to pay taxes you have to make a profit. If you want to make a bigger profit you have to lower production costs which will also increase taxes.

Norway has lower production costs than the UK despite higher wages and lower working hours.

Norwegian industry has also become more competative primarily by delivering on time and on budget compared to Asia. New fields are being developed creating new jobs and more taxes.

Is the UK doing this on purpose to make the Scottish economy look bad?

Does anyone know the sources of the numbers in this?

“So if Scotland had Norway’s oil revenues it would have run a multibillion pound surplus in the last financial year.”

But they haven’t so they wouldn’t…

“It’s true the oil price slumped by around 55 per cent but Business for Scotland noticed UK Government revenues fell by 99 per cent, even though oil production rose by around 16 per cent during the same period. It doesn’t take a genius to figure out that something other than the price of oil, is impacting Scotland’s national accounts.”

It doesn’t take a genius to point out that any revenues the government makes on the sale of oil is from the profit the companies make, so if the oil price falls by 55 percent then the entire profit margin could dry up and leave nothing – or at least very little – to tax.

“So the bigger fall in Scotland’s revenues came not from the oil price but the tax breaks that the UK Government offered the industry. ”

No evidence of this provided in the article, and you seem to just wave away the points people make in regards to the differences between the production costs in Norway’s part of the North Sea vs. the area off the coast of Scotland. Instead, you point towards the fact that energy companies paid taxes in other nations but not in this one, without elaborating why that is the case.

Also, wasn’t the SNP calling for these tax cuts…

http://www.scotsman.com/news/politics/snp-demands-package-to-reverse-north-sea-decline-1-3714767

http://www.bbc.co.uk/news/uk-politics-30852724

All the fault of the Union though, of course.