David Cameron and his Cabinet colleagues are in Aberdeen today explaining that Westminster believes an independent Scotland couldn’t realise the potential of the oil industry unless it stays in the UK.

David Cameron and his Cabinet colleagues are in Aberdeen today explaining that Westminster believes an independent Scotland couldn’t realise the potential of the oil industry unless it stays in the UK.

This proposition is absurd, and most Scots will see why. The idea that a small oil rich nation such as Norway or the United Arab Emirates can run its own oil industry successfully, but that Scotland can’t, is ridiculous. No other government suggests that a major and valuable natural asset is actually a burden on the economy, even in the case of Norway where is represents a much larger size of the economy than Scotland. Yet this is the case being made by the Tory-led No Campaign in Aberdeen as David Cameron suggests that North Sea oil is profitable for Westminster but a problem for Scotland.

Westminster would rather keep Scotland’s resources

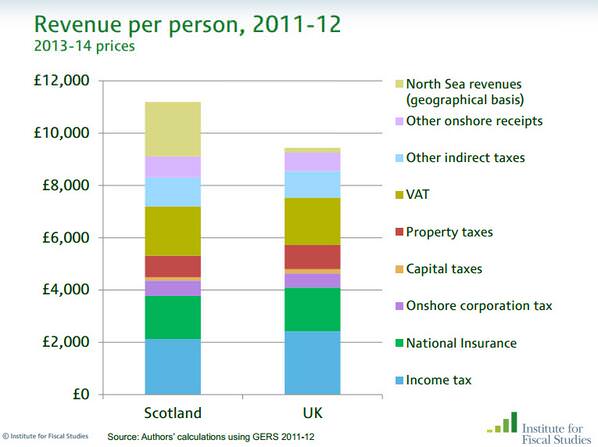

North Sea oil – responsible for a quarter of the UK’s total corporation tax – remains of huge value. Since its discovery, it has raised £300 billion to date for the UK Exchequer. No wonder the Cabinet is desperate to keep hold of it. Although Scotland’s oil fields may be past their peak, the rising price of oil means that what is left is worth considerably more than £300 billion in revenue. This figure does not include the oil reserves west of Shetland or the possibility of finding oil in the Clyde basin, where exploration is currently banned by the MOD in case it interferes with the operations of its nuclear submarines.

No business or accountant would consider such a massive long term natural asset a burden. Westminster, however, has to misrepresent the issue in case Scottish voters catch on that an independent Scotland would be in a better financial position than the UK.

Every Norwegian is now a millionaire

Any suggestion that oil is a problem would bring roars of laughter across the dinner tables of Oslo. In 2013 the Norwegian oil wealth fund reached a surplus of $828 billion – helping Norway to become the richest country in the world. This is enough to make every Norwegian a millionaire. Few are complaining.

Oil nations across the world have benefited from establishing similar investment funds. Only 2 nations have failed to do so: Iraq under Saddam Hussein and the United Kingdom.

Westminster has squandered North Sea revenue

The UK’s North Sea legacy was summed up in 3 words by Larry Elliot: “discovered, extracted, squandered”. Former Chancellor Dennis Healey conceded that North Sea wealth has been squandered by Westminster and even Alistair Darling admitted this was an error.

An independent Scotland is best placed to support the North Sea sector

A generation of oil wealth has flowed through Aberdeen – yet despite a booming energy sector, the city needs food-banks to feed its poorest residents. In September 2014 we should ask who is best placed to create economic opportunities and social gains from the second half of the oil revenues? Those who have already failed, or an independent Scotland with an energy headquarters in Aberdeen?

Westminster has caused instability

This failure has been continuous over the long term. There have been 16 fiscal and tax changes in the North Sea by UK Governments in the past 10 years. All the evidence suggests that it has been mismanagement from Westminster which has caused instability in the North Sea sector.

As Malcolm West of Oil and Gas UK said at the time of George Osborne’s tax raid,

“We’ve had three massive tax hits in the last nine years; that just cannot go on, andit’s given this country a terrible reputation for fiscal instability.” (February, 2012)

The future of North Sea oil is strong

The oil remaining in the North Sea is worth over £1 trillion at wholesale value. There are at least 15-24 billion barrels of oil remaining which will continue long into the 21st century. Over 90% of the tax revenue will go to an independent Scotland which can help to establish a national oil fund for future investment.

Business for Scotland explained the potential for a West coast oil boom that is currently blocked by Westminster. Independence could revitalise the economies of Ayrshire and the Strathclyde region as a whole. Most oil price forecasts are upward, with one of the exceptions being the UK Government’s OBR which has a political motivation to underestimate oil revenue. Alastair Darling MP of the No Campaign has described the OBR as an extension of the UK Treasury.

Conclusion

This is an evidence-based wake up call for the independence debate. Scotland has been continuously misled over the value of its natural resources and its economic ability to succeed as an independent country. Today, leading Westminster politicians repeat this claim, suggesting that a source of great wealth is a burden if the tax is collected in Scotland rather than London.

Don’t be fooled. Oil will form part of Scotland’s many economic strengths after independence.

You may also like: Where does Scotland’s wealth go?

[…] https://www.businessforscotland.com/westminster-takes-absurd-position-on-scotlands-oil/ […]

I read in “Scottish independence: the fiscal context

IFS Briefing Note BN135” that oil revenues could be divided up by UK population share post independence.

In others words, roughly speaking, and given the relative population sizes, “Its England’s Oil”.

There is no chance of that – Scotland will et a geographical share of the North Sea assets not a population share. Look up Vienna Convention 1984 and look at the sea borders versus oil field location – 96%+ in Scottish waters.

Its not about oil though its a nice bonus but the full powers of independence will allow us to significantly grow our onshore economy as well.

If you don’t want the oil to be Scottish vote NO and it won’t be – just as it is not at the moment.

Oil production has dropped 40% in the last 3 years.

Oil is not a limitless resource. In the North Sea it is becoming more difficult and expensive to extract. That means much lower revenues.

Just look at the graph here http://www.bbc.co.uk/news/business-26315319

Sorry John you are just not correct. Oil revenues dropped this year (referendum) year largely due to Westminster tax regime changes!

The key difference is a result of falling oil revenues and these have three associated root causes:

A decrease in activity in the North Sea following George Osborne’s surprise £2 billion increase in taxation for the sector in the Budget in 2011. This tax was called a wind-fall tax but it became a tax-fall measure as marginal fields were closed and deemed to expensive to run. Thus the following years have seen oil revenue drops of far more than the £2bn windfall that caused them. This is a case study in Westminster mismanagement of oil revenues.

Following the UK government back down on the windfall tax and as a remedial measure the UK Government has issued tax incentives to increase in investment in the North Sea.

Deloitte have reported that the number of new fields that started production in the UK rose by 44pc last year, reaching the highest level since 2008 as international oil companies (IOCs) took advantage of new tax allowances for small field discoveries and so-called “brown field” developments.

However higher investment, some of which can reduce taxation liabilities (due to new tax exemptions) has reduced North Sea oil revenues quite dramatically in the referendum year (although this investment will generate higher revenues in the future).

3) Gas production has now resumed at the Elgin-Franklin platform complex, almost one year after a leak created an emergency shutdown. The shutdown, reduced the UK’s gas output by approximately seven per cent and led to 14% fall in oil and gas revenues costing the treasury and GERS billions of pounds.

Output is expected from the Elgin-Franklin gas-fields east of Aberdeen to return very quickly to approximately 50% of the level of its pre-accident output of about 140,000 barrels of oil equivalent a day, growing to full production in the medium term, thus raising Scotland’s oil and gas revenues significantly in the post independence years.

http://www.telegraph.co.uk/finance/newsbysector/energy/oilandgas/10603454/North-sea-tax-breaks-are-working-says-Deloitte.html

Its not the case that the oil is running out and production has fallen by 40% its actually westminster incompetence in 2011 mixed with tax incentives to invest this year and a major shut down that have caused oil revenues to drop.

You have to see past the oil in Scotland .. oil is only one natural resource that Scotland has.. the biggest resource is energy , Scotland right now is a net exporter of electricity and has the potential to export 100% over and above what Scotland needs .. this natural resource could see the end of the combustion engine in Scotland and the oil will become a completely for profit resource.. petro chemical, R&D etc. could see Scotland rival Norway on that rich league within a few short years .. UK IS FINISHED!

I am English and part of the vast couldnt care less camp. However reading some of the comments on this and other sites there seems to be a lot of racism and bitterness towards England and the English yet Scotland seems to have done reasonably well out of the Union, certainly as far as government spending. My local shipyard Cammel Lairds would love just a sniff of the work Clydeside has been promised. If your going thats fair enough but dont get bitter about things that were in no way the fault of pretty much the whole of England most of us werent even born when some of these things were settled. There certainly arent any politicians still in Westminster who had anything to do with North Sea oil. If your going thats saddening but dont go with bitterness thats how wars start.

The only reason I can think of that you might think there is bitterness towards the English is because you think we are arguing against English rule. We are not, the people who have done the most to harm Scotland are Scots with no vision for Scotland, no belif in Scotland and no hope nor plans for our future. We elected them, Brown, Darling etc etc so its our fault. My home town is Hexham in Northumberland – anti Westminster is not anti English. There are many many English people on the Yes side of the debate.

Interesting discussion on the BBC “This Week” program,last night (Thursday) Andrew Neil,the host,with Michael Portillo and Alan Johnson.The subject moved from the Scottish independence to discussion on the probable referendum over the European Union.The parting line from Michael Portillo was that the Britnats would use the same tactics as they are using over the Scottish referendum and that would be the “Tactics of Fear”. Now this is from a man in the know,and agreed by the other two.Pat Kane also gave a very good contribution on the debate.We have the news stories about who is against independence being dripped fed to us.Did Standard Life not realise that we were going to have a referendum some three years ago,and could they not have issued their plans for a possible change of venue for Some of their Investments when they first found out? could an independent Scotland not manage to be a better place to invest with independence,just asking?

I hate the fact that ministers and their spin doctors continually release information that they know is not correct. You are there to represent the general public not to feed them propaganda rubbish. There should be a fine for spreading misleading information when you have access to the truth. Governments have been doing this for years. People of Scotland. Do not listen to what you are being told. Use your hearts and do not be guided by miss-truth.

Im 56yrs old and oil prices have never been low , you might get a price cut at the pumps but that never lasts and the oil price goes up n up we have been lied to for years by these so called leaders each one as bad as the other, or dont you remember CHEAPER OIL FOR EVERYBODY lies that we were told by these people in positions of trust. Now our destiny is in our hands lets not waste it.

Yes the prices for fuel are extortionate, however it’s TAX that makes it so.

If you are saying that fuel will be a lot cheaper post independence then how will the TAX shortfall [ TAX you know the stuff politicians love to squander] be made up?

PS Oil incomes are volatile at the best of times. What if the companies decide to go somewhere else where there are untapped resources that do not require the same investment to extract the oil? Like the Falklands for example.

That is simply not true. Right now, only 27% of the UK’s oil comes from the North Sea, and it’s not Tax that is the reason for it being expensive, it’s the price of buying it.

You should be thankful it’s expensive anyway, as we only have maybe 30 years more of it on this planet and then we will start living on country oil reserves.

Finally, Oil incomes being volatile is tosh. In this day and age if an oil corp goes somewhere else you don’t even have to worry, because they will be back, and the prices will be higher by then allowing you to gather more money via tax.

Yep, IF oil price were to collapse then a sensible government would mothball production until prices increased and use their oil tax wealth fund to tide them over the meantime, oh wait. We squandered that chance on building a banking and services industry 🙁 Oil is used for many more things than fuel energy for which we don’t have alternatives, so oil will always be needed. Thankfully Scotland has a robust economy to survive the shortfall and NOT require the massive bail out the banks demanded ( and got )

If oil is $100,per barrel,divided by 65 million=1.54 each,same X5 million =20 each;now even if the prices drop by 50% it would be 50 divided by 5=10 still lots more left here.

A good article, but you can please add Brazil to the very short list of countries that have not set up an oil & gas investment fund. Like the UK, Brazil has a dysfunctional government which does like planning for the future.

“The “too small, too poor and too stupid” argument has become so discredited recently that none of the major players in the No Campaign now dare to suggest it.”

https://www.businessforscotland.com/revealed-the-accounting-trick-that-hides-scotlands-wealth/

Is that not what David Cameron has just said? We need the UK’s ‘broad shoulders’ and ‘bottomless pockets’. We couldn’t do it ourselves? Looked like ‘too poor, too wee too stupid’ to me!

I say ‘Independence for Shetland’.

Oh …. and we will keep the oil and the fish.

Shetland doesn’t want to be ruled from Edinburgh/Glasgow any more than it wants to be ruled from London.

12 mile territorial limit, you’re welcome.

Good idea.

Worth considering a currency union with Norway.

Norway has a national debt of 759 billion NKk

yep, which is less than 70billion pounds which is about on a par with ONE HALF of the UK national ANNUAL deficit. Don’t let big numbers scare. Also its less than one quarter of their GDP AND they have a massive oil wealth fund to offset it when interest gets high. Not all debt is bad debt 🙂

Sure,. if you wanna take your fair piece of the debt and stop acting as if you have no obligation to a gov’t that spent money on you as well.

You weren’t always in some oil mining revolution, and to be quite honest we did a hell of a lot for each other since 1603, so if you want out, you have to take your piece of the debt too and stop being so greedy.

The debt the UK ran up wasn’t spent on Scotland though was it!

https://www.businessforscotland.com/revealed-the-accounting-trick-that-hides-scotlands-wealth/

Gordon

Just like to say that there is not only oil in scotland as more of our own natural gas is shipped across the world than is kept here and then we need to buy it back

What amount is likely to go into the Scottish Oil Fund?

Its about time England stood on there own we have supported them long enough, independence can’t come quick enough

the Prime minister, on his little jaunt to jockland, is trying to hoodwink the Scottish electorate by his comments on Oil.he puts it across, that a great britain with broad shoulders and deep pockets, is the only answer for our future, Scotland of course, being too small, inexperienced at governing those resources would be a disaster. I think not, and while the oil will not last for ever,the same can be said about world oil. we still have billions of tons of coal under our land, and although it is not a preffered option,there were great strides being taken in processes to limit emmisions from power stations, the tories shut the whole thing down, and still used European coal at a reduced rate (they say) for years and are still doing so. the canonbie coal reserves in dumfrieshire are still untouched.

Correct me if I’m wrong, but isn’t Norways major oil company owned by the state? Likewise the UAE. If that’s the case, are we to take ownership of the oil companies operating in the North Sea too? Or is this a case of comparing apples and oranges to get the answer you want.

A genuine question from someone looking for answers

Norwegian state owns 67% of Statoil, the largest player in the Norwegian sector. There are others, privately owned. This obviously increases the Norwegian government’s ‘take’ from the oil, as they own the source of profit as well as tax.

Thanks for that. I wish more accuracy was used when making comparisons, the oil fund is a great idea but simple direct comparisons don’t really work, we in Scotland don’t own chunks of the oil companies and I’ve yet to hear the idea of part or even complete nationalisation being out forward. The arguments need to be far more detailed or neither side in this debate is being being completely honest with the electorate

Are not the oilfields in international waters. Hence Norway accessing the same oil. If so calling them a Scottish asset is misleading. I don’t know if this right. But as a pipeline can be drilled sideways the british goverment can access the oil anyway from outside scottish waters.

No not at all – all the oil classified as Scottish is geographically located in what would be Scotland territory as an independent country. All the Oil associated with Norway is within their national boundaries.

What constitutes oil geographic boundaries is very clear in international law. Licences are issues by the government who’s territory the oil sits in and so no one but the licensed company can drill there.

Actually you are wrong, as there are a few actual oil reservoirs stretches that reach outside the borders of ‘what would be Scottish territory if it was independent’. As a result, the UK could feasibly make a rig ‘at the other end of the bathtub’ and drink from the same wells.

You are measuring it based on Scottish territorial ideals, whereas the rest of the world measures it based on the same principle as the United Nations Convention on the Law of the Sea (UNCLOS), the Median line. Scots have already argued this in court before as allegedly ‘taking away a large part of Scottish territory’, but unless you are saying that the UN designed all it’s sea laws to screw over Scots, then fair is fair.

Craig Murray the former ambassador says

I was the Alternate Head of the UK Delegation to the UN Convention on the Law of the Sea, and was number 2 on the UK team that negotiated the UK/Ireland, UK/Denmark (Shetland/Faeroes), UK/Belgium, and Channel Islands/France maritime boundaries, as well as a number of British Dependent Territories boundaries. There are very few people in the World – single figures – who have more experience of actual maritime boundary negotiation than me.

The UK’s other maritime boundaries are based on what is known formally in international law as the modified equidistance principle. The England/Scotland border was of course imposed, not negotiated. It is my cold, professional opinion that this border lies outside the range of feasible solutions that could be obtained by genuine negotiation, arbitration or judgement.

His conclusion is that In 1999 Westminster redrew the existing English/Scottish maritime boundary to annex 6,000 square miles of Scottish waters to England, including the Argyll field and six other major oilfields. The idea was specifically to disadvantage Scotland’s case for independence.

An interesting point is that in percentage terms even the fields in question represent less than 5% of the UK err sorry Scottish oil reserves.

Information about the norwegian oil fund.

http://www.nbim.no/

http://www.nbim.no/en/

Probably be easier in English 🙂

Really not getting Westminster at all on oil. Why does the UK energy minister say the oil investment is on the decrease. Then Mr Cameron has plans costing millions to create a carbon capture plant in Peterhead. Am I the only one that can’t fathom this out? Why build a carbon capture plant for a natural resource that is on the decrease? Or is it another lie we are being told?

This carbon capture and Storage plan for Peterhead PowerStation is yesterday’s news. The SNP govt wanted BP to go ahead with this in 2007, but Energy is reserved to Westminster and they said wait until we have a competition first to see who can come up with a better plan. BP were thwarted in their original proposal which should have been operating in 2011, removing the CO2 of the equivalent output of 100,000 cars.

Now we will wait untill after the next UK general election to perhaps maybe have a serious think about possibly doing a feasibility study.

Check out BP Peterhead Hydrogen to Power. Using the Miller field for ccs would have produced 15-20years of additional oil production recovering approx 40Mn barrels of crude. Instead the field was capped and abandoned. HMG refused to invest the £600m BP requested to finance the project, estimated at the time to produce enough energy to power 250,000 homes from clean hydrogen split from natural gas. But it was the baby of Holyrood’s new SNP govt not Whitehall, the outcome was therefore never in doubt. At today’s rates how much is 40Mn barrels of North Sea Crude worth to the exchequer?

Time to send the Westminster Government homeward tae think again

The comparison with Norway is a nonsense.

Norway has £450 billion in their fund and are adding to it at a rate of £30 billion a year.

Scotland has £0 in their fund and may be able to put in £1 billion a year but only if oil prices are high.

And who’s fault is that? Are you suggesting that the UK government with a track record of mismanagement of Scotland’s oil revenues needs to continue mismanaging them because, well, they mismanaged them?

We need longer term thinking for a government that actually cares about Scotland.

Well said. When a burglar nicks my DVD player I’m not going to offer them my TV as a reward!

Where do you get that figure of £1 billion from? Sounds like nonsense to me, especially if you factor in the west coast oil…

West of Shetland sites the biggest oil firle din Europe – Clair Ridge has had a £4.5billion investment in the second phase of developmentan estimated eight billion barrels of oil in place.

This investment stalled as the UK governments careless tax grabs meant 16 changes in tax system for North Sea – Investors require stability

There are at least 15-24 billion barrels of oil remaining. The remaining reserves are worth over £1.3 trillion.

The UK government predicts a 28% rise in demand by 2035.

Ipso facto his £1bn limit to the fund figure is just unionist nonsense as always – could be initial seed funding but we could put far more in if finances managed correctly.

If we don’t get a fair share of the assets we will have £4.1bn less interest payments in debt year maybe we can put that in?

Not to mention the totally ignored reserves west of Lewis towards the Continental Shelf.

Good point about investors requiring stability – the very thing that we’re being led to believe can only be provided by Westminster.

In what way is comparing Scotland to Norway nonsense?

Both countries have historical links as old as those with England. They have approximately the same 5million population.

Norway recently gained independence from her larger richer neighbour.

Until oil was discovered within her territorial waters Norway was relatively poor in European terms.

Norway is in the top 4 richest countries on the planet and even then only spends about 4% of her oil income per year, the rest is invested globally as a hedge for the future, currently said to be worth over £100,000 for every man woman and child in Norway.

Scotland discovered oil at the same time, but was warned that a small northern European nation depending on oil would soon become another Bangladesh or Albania, that the oil would run dry after 1990 and England would have to rescue the sick man of Europe. This at a time when Jim Callaghan’s Labour govt had to go cap in hand to the IMF for hand outs to save the UK from bankruptsy!

No Risky, fool me once shame on you, fool me twice shame on me…

What is left over to invest in the oil fund per annum?

I thought it was a billion but I could be wrong.

Help!

Scotland’s oil fund will be tiny in comparison to Norway’s.

It is a shame about the past but how can we ever get a large oil fund.

I think you may be losing a yes vote.

@risky very true,

Norway decided very early on after oil started flowing that they were going to put the revenues into there oil fund and not use them to fund government expenditure & they made some hard choices down the decades to make that happened.

Even today the vast majority of there oil tax/dividend payments are invested into the fund & not used for government expenditure (my understanding is the fund takes off a very very small percentage to fund it’s own operation costs).

It also meant Norwegian public finances were not subject to the whims of the oil market, some years the fund got more cash, some years less.

As for why the UK Treasury never set up a oil fund, Oil permits and extraction taxes have never brought the UK Treasury more than 2.5% of Westminster overall revenue.

14 billion per year as a % of 670 billion [2013].

From what I understand the argument at the time was better to boost health and education & infrastructure spending, in effect investing in the next Generation’s economy, rather than letting the money sit idle for a few decades & again, some years the UK Treasury got more oil tax, some years less.

Same reason the USA don’t set up a oil fund from the huge revenue the Gulf of Mexico generates. It would grow to be a reasonable amount in a short few years, but as a % of american federal spending it would never amount to a huge total.

In short, while oil funds can help small country’s smooth out the peaks and troughs, they only work if you leave them to grow and don’t raid them till you have to. Large economies have no need for such national safety nets & there governments often spend the money to improve there country’s current infrastructure.

[…] Westminster takes absurd position on Scotland’s oil […]

Scotland couldn’t realise the potential of oil? Why? Because we’re just barbaric jocks?

That is just down right racist and insulting our intelligence.

good articles